George Osborne’s Autumn Statement announced a change in the way stamp duty works. The government say that the new system will benefit 98% of us. If you are buying a home for less than £937,500 you’re likely to save money.

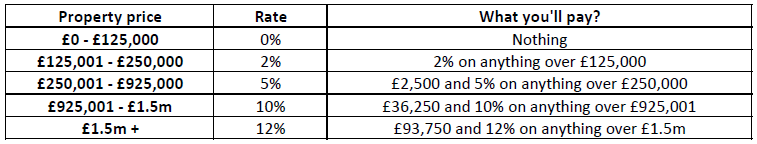

Stamp duty will now be charged more like income tax. So, you’ll only pay the higher rate of stamp duty on the portion of the total value which falls within each band.

What does that actually mean?

You’ll pay the following:

The newly reformed stamp duty will run in Scotland until April 2015 when the scheme will be replaced with Land and Buildings Transaction Tax.

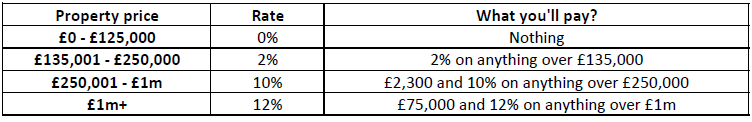

How does Land and Buildings Transaction Tax compare?

Under the Land and Buildings Transaction Tax you’ll pay:

Should I buy now or wait until April?

If you’re buying a home for more than £250,000 you are likely to pay more under the Land and Buildings Transaction Tax. If you were buying a home worth £275,000 you would currently pay £3,750 stamp duty but under the SNP’s Land and Buildings Transaction Tax you’ll pay £4,800.

Conversely, if you’re buying a home for less than £250,000 you’ll benefit more from the Scottish Government’s scheme. For example, if you’re buying a home for £200,000 you’ll pay £1,500 currently and £1,300 under the new system.